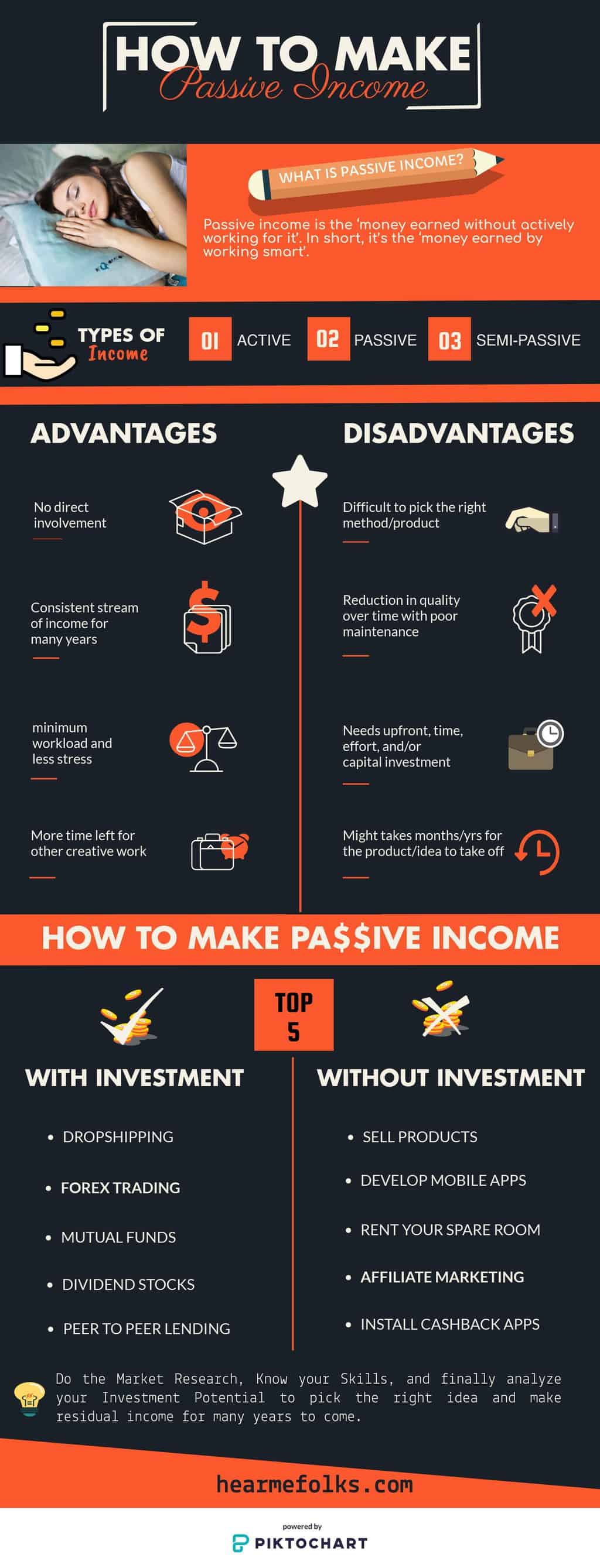

This is generally a longer-term investment of at least five years. You can earn returns from dividends (generated by rental income) and when the property appreciates in value. The platform will automatically invest your money in different properties, so there's little to no learning curve. With real estate crowdfunding, you pool money with other investors to fund properties together. Residual income is money you continue to receive even after all the work is done (such as song royalties, YouTube ads, or stock photo downloads).

Residual income is a type of passive income. Passive income is money earned when you're not actively working. Access to tried-and-true investment strategies.Small minimum investment, depending on the platform.Invest without the need to micro-manage your financial accounts.See our complete guide to the best robo-advisors. All you have to do is fund your account.Ī lot of robo-advisors don't have a minimum, so you can open an investment account even if you don't have a lot of money.

#Making passive income software#

Just answer some questions about your goals and risk tolerance, and the software algorithms will create an investment strategy for you. Just sit back and let the investing platform do all the work. They pick investments for you and manage your portfolio, so you don't even need any investing knowledge or practice. Robo-advisors automatically invest for you. Depending on the income source, your upfront investment could be as little as $5. The following passive income streams require investing some money upfront. Passive Income Ideas with an Upfront Investment Refinancing your mortgage could save you a few hundred a month, while a successful blog or podcast could earn several thousand.īy combining several of these passive income strategies, it's possible to add an extra $1,000 a month to your bank account. How much passive income you earn depends on what you do. Hopefully, this list will inspire you to start your journey to build passive income and achieve financial independence. Read on for the best passive income ideas, as well as the difficulty level to get started and make money. That way, you can avoid wasting time and resources on something that won't work. It's best to do your research and learn everything you can about your preferred passive income source before committing. That way, you can sustain whatever source you choose.Īfter all, even though passive income ideas require less effort, that doesn't mean there's zero effort involved. Knowing what you have or don't have can be a good way to identify how you can start earning passive income.īefore you decide on a passive income stream, make sure you stay realistic about your goals and capacity to commit.

You can start by asking yourself questions like: To find the best passive income strategy for you, think about what you can utilize. Here are some tips that can help you out: To maximize its potential, you need to find the best passive income stream for you.

0 kommentar(er)

0 kommentar(er)